How much can i borrow for an investment property calculator

Include all your revenue streams from alimony to investment. Figure out how much you and your partner or co-borrower if applicable earn each month.

Mortgage Calculator How Much Monthly Payments Will Cost

Managing your ANZ Mortgage open secondary menu.

. If youre a foreign buyer you will still be entitled to the concessions like first home or first home vacant land as long as you meet the other criteria of. Getting your mortgage pre-approved. Like any form of investment theres a lot to consider before you make the jump as.

How much can I borrow. Generally speaking and depending upon your location they will typoically range from about 05 to about 25 for Taxes and 05 to 1 or so for Insurance. How much can I borrow.

In some ways learning your borrowing power is the first step in any serious property search. Once youve played out with the investment property calculator we can help you qualify for an investment loan to buy a new property. A Buy to Let mortgage is a loan secured against one of these properties.

Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. How much can I borrow. Discover the latest Australian property investment news and information for investors homebuyers and real estate professionals.

Costs associated with getting a mortgage. Under this formula a person. Find out how much you can afford to borrow with NerdWallets mortgage calculator.

Choosing the right home loan. Buying a home is still considered a key aspect of the American dream. See your total mortgage payment including taxes insurance and PMI.

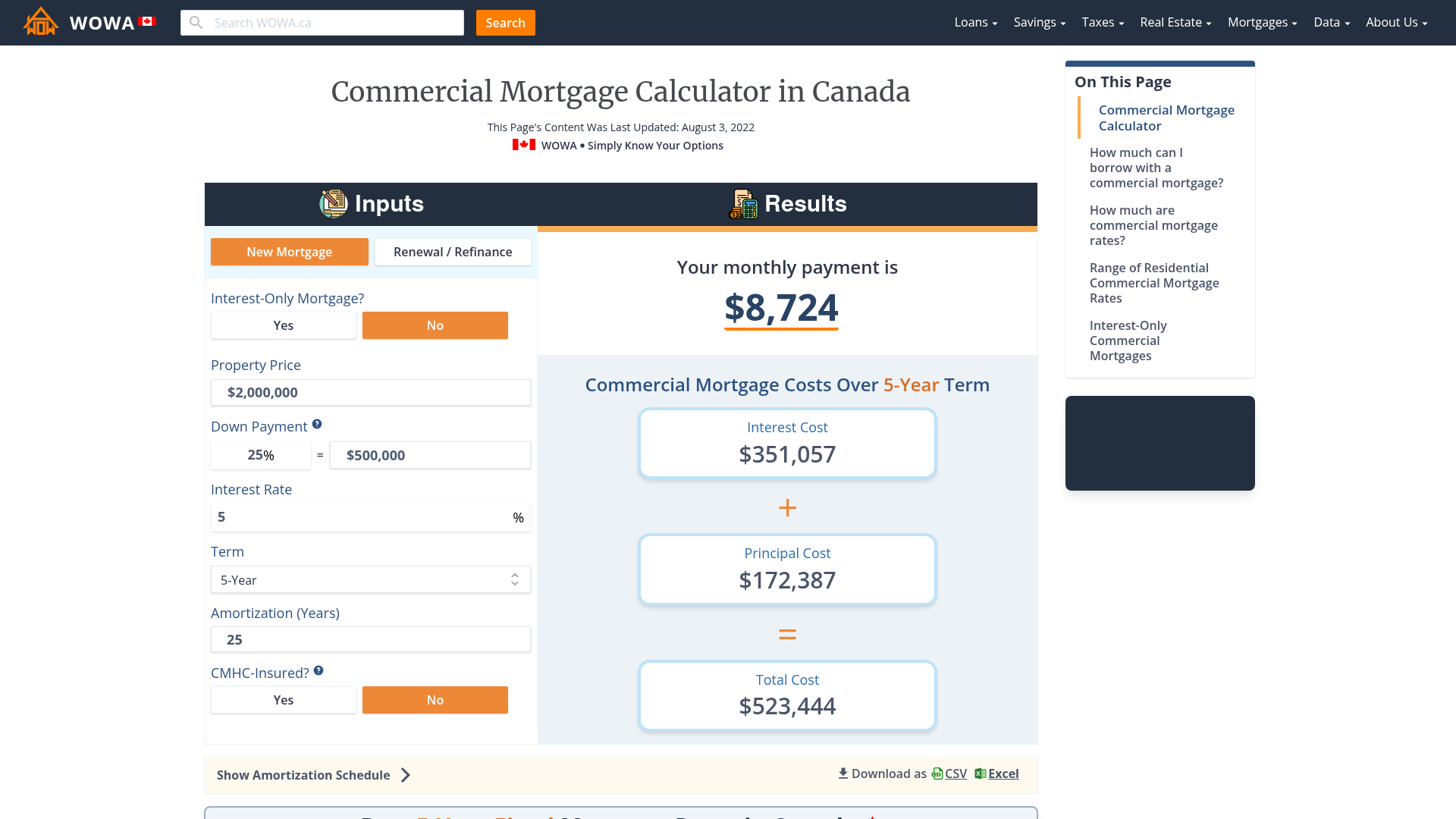

The results can be displayed in a graph or a table showing total loan costs repayments and how much of the principal of the property you would be paying off over time providing you choose a principal and interest loan rather than an interest-only loan. The calculator will ask you for your income a property value and deposit amount. In order to calculate how much you could borrow we need to base our calculation on an interest rate.

Maximum borrowing amounts can even differ up to 3x between different banks. This will allow you to check the rates that are available to you. This borrowing calculator does not provide financial advice and.

Which home loan is right for. What mortgage can I get for 500 a month in the UK. Myth 2 The maximum loan amount you can get from each bank doesnt vary much.

Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. What is a Buy to Let mortgage. The mortgage calculator on this page can help you estimate your borrowing power using some basic details about your financial situation.

Paying 500 a month over 25 years means you are paying back 150000 but your mortgage will also include interest - which is charged per. A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit. Calculate the cost of your home loan repayments using our loan repayment calculator to find out how much you can afford to borrow.

Enter your details in the calculator to estimate the maximum mortgage you can borrow. Foreign investors other than New Zealanders with a special category visa will have to pay foreign citizen stamp duty of 7 of the property value on top of their transfer duty. Your personal income and expenses will still factor in to your borrowing power because a lender will want to ensure that you dont go in to financial hardship if things go.

If youve already started looking for properties you can enter a property value and deposit amount into the calculator and well show you your Loan to Value LTV ratio. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage. As a first-time buyer you have access to state programs tax breaks and federally.

This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. Compare how different interest rates loan terms and repayment frequency can.

Use our mortgage borrowing calculator to find out how much mortgage you could borrow to buy a property based on your income and whether youre buying with anyone else. After performing the calculation you can transfer the results to our mortgage comparison calculator where you can compare all the latest mortgage rates. This borrowing calculator is intended as a guide only.

Top up your mortgage. Get mortgage free faster. Affordability calculator get a more accurate estimate of how much you could borrow from us.

When your fixed rate mortgage ends. Calculate how much you can borrow. The purpose of the loan will impact your ability to borrow because a lender will also need to consider potential income or expenses associated with an investment property.

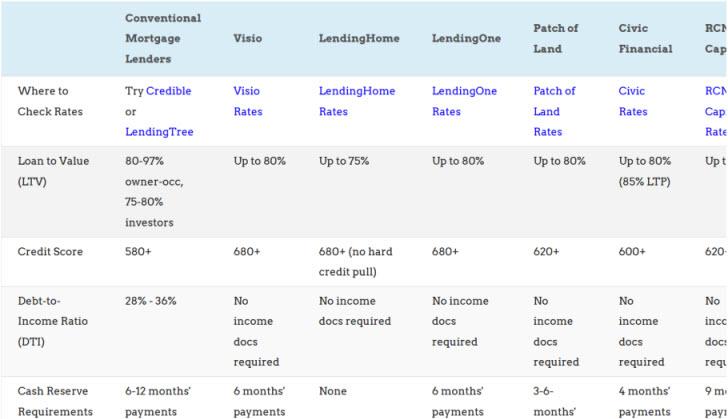

What is the stamp duty surcharge for foreign investors. Myth 3 Banks only lend up to 70 of your DSR. The rate youll get is determined by your credit and financial profile including the.

Having a good idea of what you could buy can make it easier to find an affordable property. Buying an investment property. There are enough exceptions to say that credit policies can differ greatly from one bank to another.

Start by crunching the numbers. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. In this example we have used the current Residential Owner Occupied rate for our Classic home loan. The amount of interest youll pay to borrow the.

Benefits of Being a First-Time Homebuyer. Use this mortgage calculator to estimate how much house you can afford. Speak to our mortgage brokers by calling 1300 889 743 or fill in our free assessment form to find out if you can qualify for.

Investment property mortgage rates are the interest rates lenders charge for an investment property loan. How to calculate how much house you can afford. Offset calculator see how much you could save.

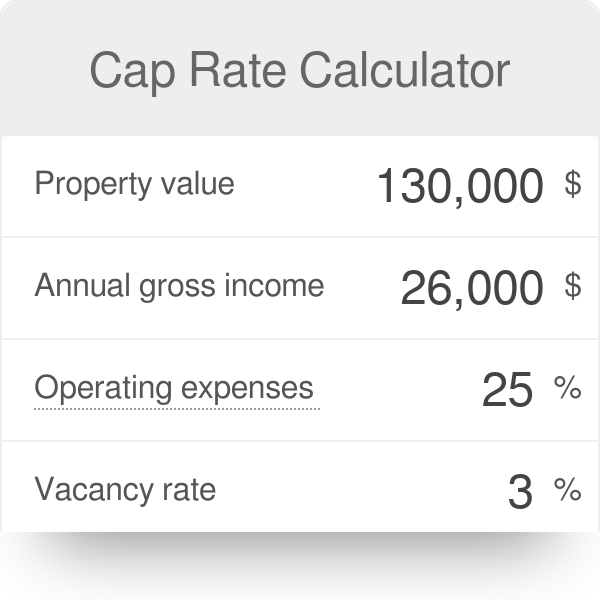

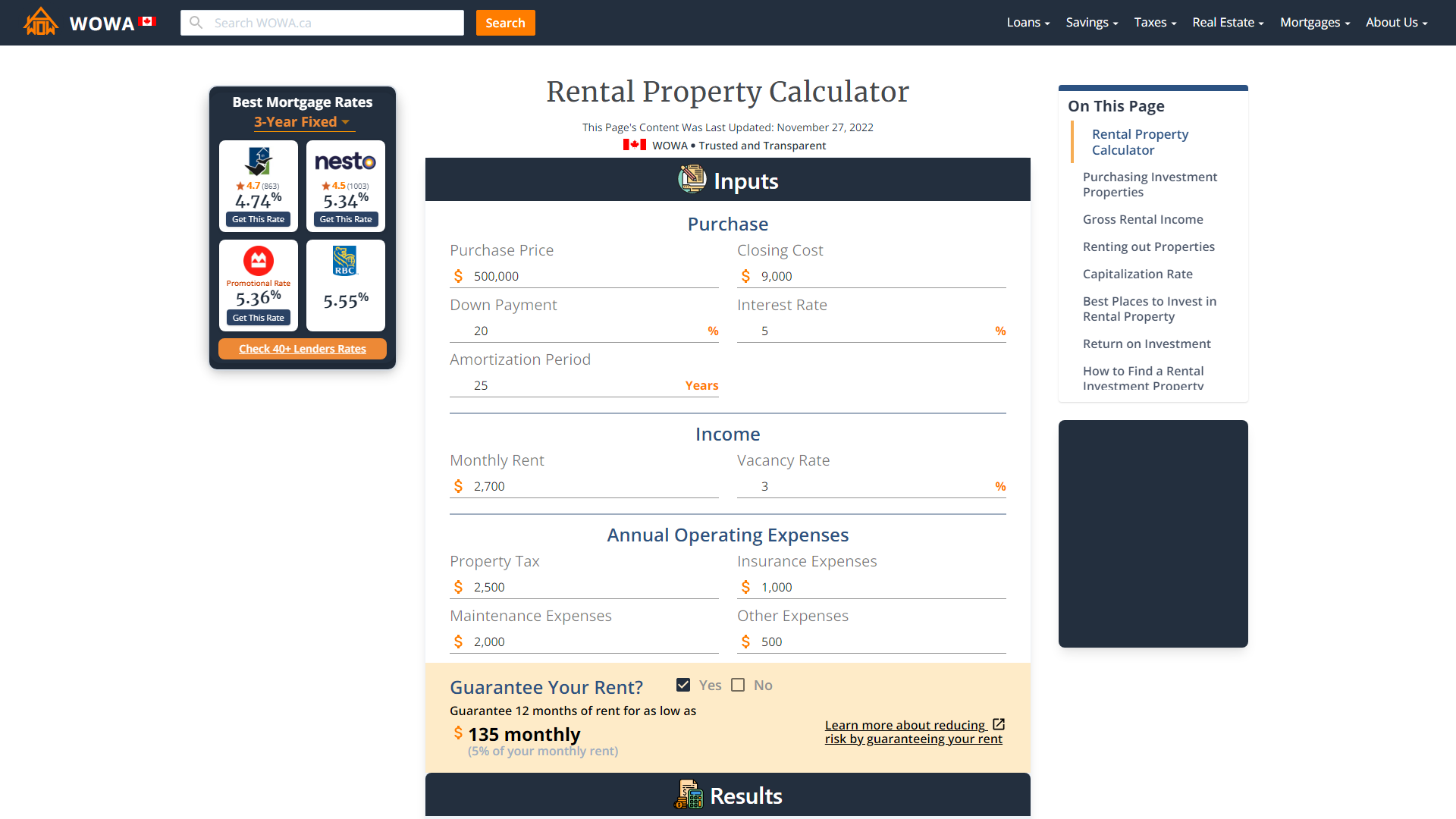

It takes about five to ten minutes. To produce estimates both Annual Property Taxes and Insurance are expressed here as percentages. A return on investment ROI for real estate can vary greatly depending on how the property is financed the rental income and the costs involved.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Bfiltqjc Ibeqm

Mortgage Affordability Calculator 2022

Investing Calculator Borrow Money

17 Clever Ways To Cover A Down Payment For An Investment Property

Cap Rate Calculator

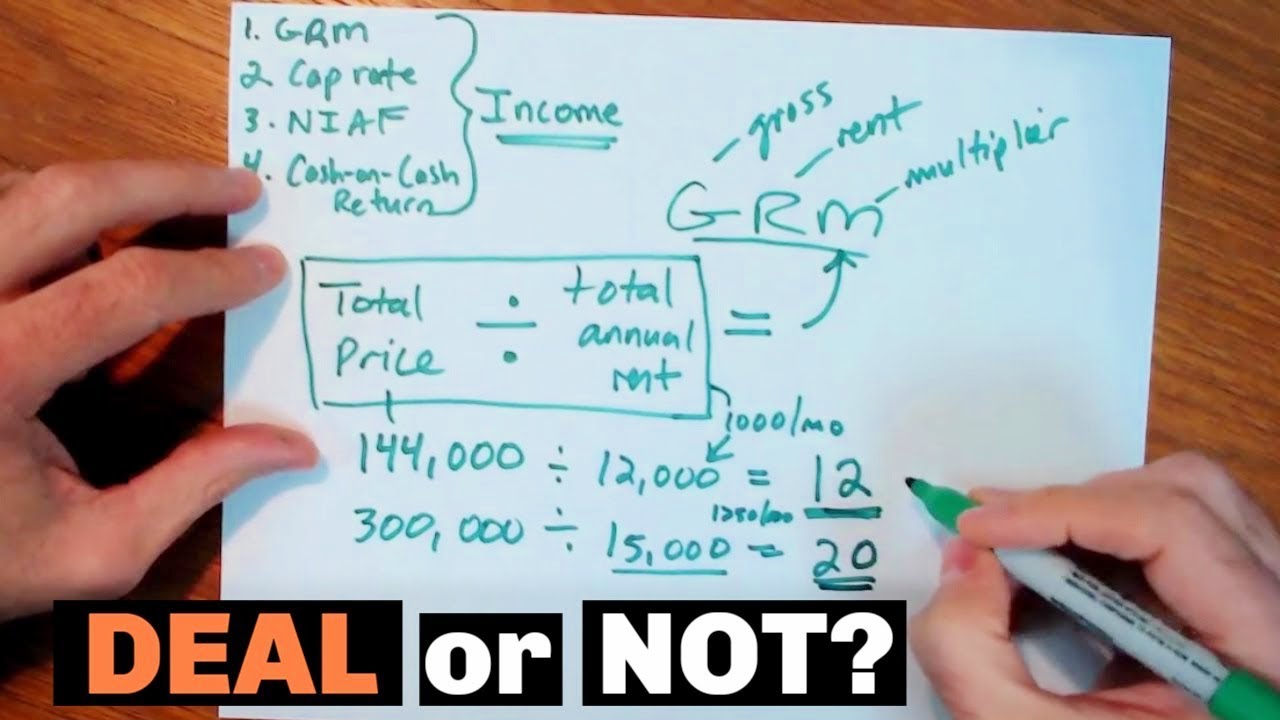

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Run The Numbers For Rental Properties Back Of The Envelope Analysis

Rental Property Cash Flow Calculator

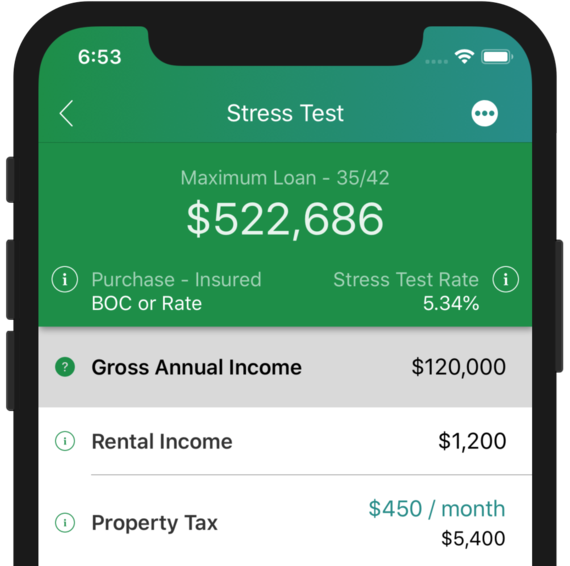

Stress Test Calculator Canadian Mortgage App

Rental Property Cash On Cash Return Calculator Invest Four More

How To Calculate Roi On Spanish Rental Property

Lzbw6a1vckffem

Loan Calculator That Creates Date Accurate Payment Schedules

Mortgage Calculator How Much Monthly Payments Will Cost

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental